Hannah Sheridan & Cochran's own podcast, previously available via Spotify, is now available to listen…

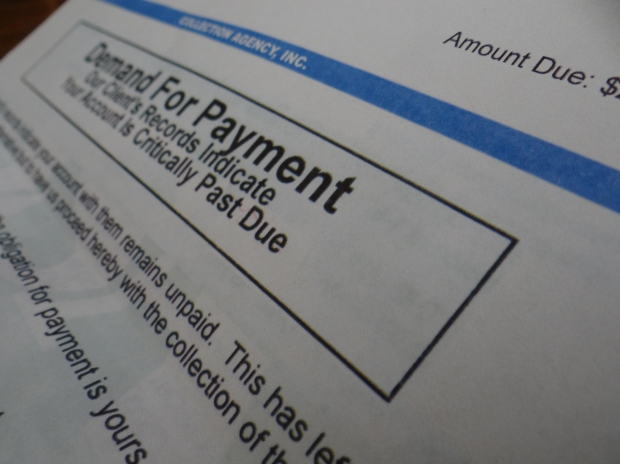

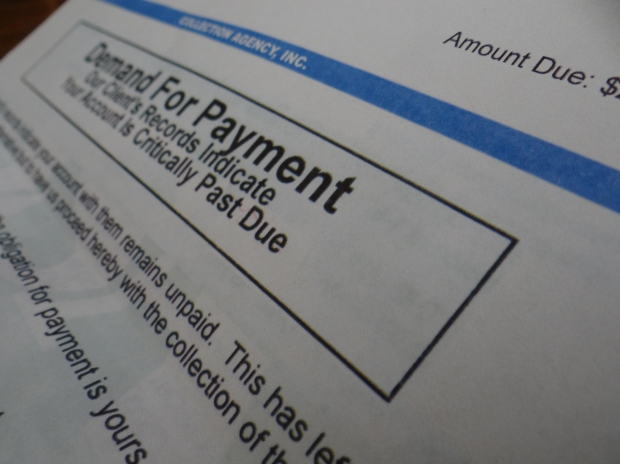

PROPOSED CHANGES TO THIRD PARTY DEBT COLLECTION

On Thursday, July 28, 2016, the Consumer Financial Protection Bureau, a governmental agency created in 2008 to protect consumers, proposed a large-scale overhaul of the debt collection industry. The proposal marks the biggest overhaul of the $13.7 billion debt-collection industry since the passage of the Fair Debt Collections Practice Act in 1996. The changes include: 1) the requirement of debt collectors to confirm the existence of the debt and possess sufficient information before instituting collection efforts, 2) the prohibition of the filing of a lawsuit after the Statute of Limitations has expired, 3) the requirement of debt collectors to provide information to the consumer related to the consumer’s rights, written in clear English, and 4) would limit the number of contacts a debt collector can make in 1 week to six times. The CFPB will now hold hearings on the proposed changes, resulting in formal, finalized rules later in 2016. The public then has 90 days to comment before they take effect. For more information on the Consumer Financial Protection Bureau, see www.consumerfinance.gov.